When contemplating an employee mortgage, it is essential to evaluate components corresponding to compensation terms, rates of interest, and potential impacts on one's credit score score.

When contemplating an employee mortgage, it is essential to evaluate components corresponding to compensation terms, rates of interest, and potential impacts on one's credit score score. Having a clear understanding of the phrases will help in making an informed determination that aligns with personal monetary go

What Are Low-Credit Loans? Low-credit loans discuss with credit score products designed for people with a below-average credit score. These loans usually characteristic greater interest rates and less favorable terms in comparability with commonplace loans, reflecting the increased risk for lenders. Borrowers typically search these loans as a means to handle financial emergencies or begin rebuilding their credit history. This class of loans includes personal loans, payday loans, and secured loans, among others. Each type offers varying compensation phrases and structures, making it vital for people to assess their monetary situation before committ

Alternatives to Low-Credit Loans

Before opting for a low-credit mortgage, consider exploring different choices. Some alternatives embrace borrowing from friends or household, which typically comes with more flexible compensation terms. Additionally, community organizations might supply monetary help applications or grants. Another possibility is to build a secure credit score historical past via secured bank cards, which can finally enhance credit score scores and open up access to raised mortgage options sooner or later. These alternate options can mitigate the necessity for high-interest lo

Introducing 베픽: Your Low-Credit

No Document Loan Resource

For those in search of detailed information about low-credit loans, 베픽 serves as a useful resource. The site presents intensive evaluations on various mortgage products, helping borrowers perceive different options out there to them. Users can discover comparisons of interest rates, phrases, and lenders, making it easier to identify your greatest option for his or her distinctive state of affairs. With in-depth articles and guidance on navigating the world of low-credit loans, 베픽 empowers people to make knowledgeable borrowing selections. Whether you want instant financial help or want to rebuild your credit score, 베픽 is there to support you on your monetary jour

Potential Risks Associated with Employee Loans

While worker loans provide many advantages, potential dangers must also be considered. For instance, employees might find themselves in a cycle of borrowing if they do not manage their funds rigorously. Relying too heavily on loans can result in monetary misery if unexpected expenses ar

Introduction to BePick

For those in search of comprehensive information on Daily Loans, BePick is a priceless useful resource that makes a speciality of monetary critiques and guides. BePick supplies customers with detailed insights into varied lenders, helping them navigate the advanced landscape of economic products obtainable right

Eligibility for employee loans usually varies by employer or mortgage supplier. Common criteria include being a full-time worker, having a minimal tenure with the company, and a passable credit history. It's advisable to verify with your HR department or the lending institution for particular necessities associated to eligibil

Understanding Daily Loans

Daily Loans, by definition, refer to short-term borrowing choices that are designed to provide funds quickly, usually inside a single enterprise day. They are typically used for urgent expenditures, similar to medical bills, automotive repairs, or sudden family prices. These loans could be a lifeline for these facing financial emergencies, providing immediate access to money with out the prolonged approval processes of conventional lending instituti

However, it’s crucial to focus on the related prices, including greater rates of interest typically charged on these

Other Loans compared to long-term loans. The velocity and comfort of acquiring funds can lead debtors to miss the potential financial burden that may arise if the mortgage isn't managed responsi

Advantages of Business Loans

Securing a enterprise

Small Amount Loan comes with numerous advantages that can significantly contribute to the overall progress of a business. One of the principle advantages is the infusion of quick capital, which can be employed immediately to satisfy urgent financial ne

Eligibility Criteria for Business Loans

Understanding the eligibility standards is crucial for anybody trying to secure enterprise funding. Lenders consider a quantity of components, including credit scores, enterprise financials, and operational historical p

Risks Associated with Low-Credit Loans

Borrowers must additionally be aware of the dangers involved with low-credit loans. Due to their larger interest rates, individuals may discover themselves in a cycle of debt if they can't meet the compensation terms. Additionally, some lenders could engage in predatory lending practices, focusing on susceptible borrowers with unfavorable terms. It is crucial to thoroughly research lenders and skim the fantastic print to avoid hidden charges and unfavorable circumstances. Moreover, relying solely on loans to cowl expenses will not be sustainable in the long term, highlighting the significance of price range managem

Appease you test unlit alternate down

Appease you test unlit alternate down

Exploring the Global Drama Craze: Gimy劇迷, Dramasq, and Gimy

By Dramasq

Exploring the Global Drama Craze: Gimy劇迷, Dramasq, and Gimy

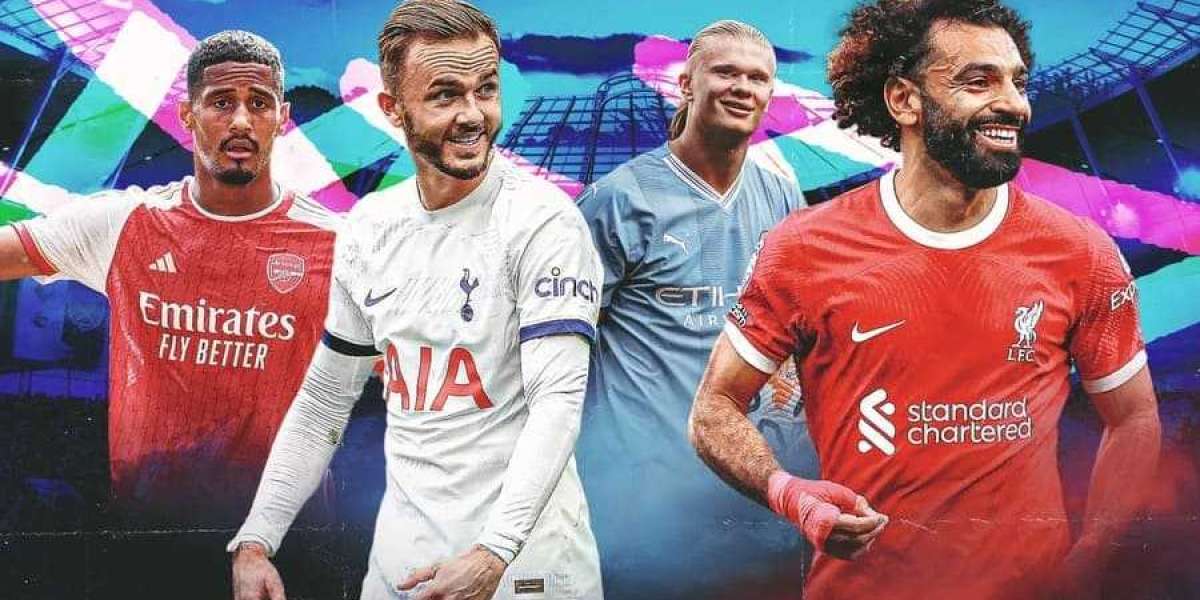

By Dramasq Barcelona je krenula autogolom! 1-3 pobjeda Valladolida i ispadanje

Barcelona je krenula autogolom! 1-3 pobjeda Valladolida i ispadanje

Manchester United videre til ottendedelsfinalen i FA Cuppen efter hård kamp

Manchester United videre til ottendedelsfinalen i FA Cuppen efter hård kamp

Enzo skóruje při svém debutu, když Chelsea otočila zápas s Wimbledonem a postoupila do třetího kola Ligového poháru (2:1

Enzo skóruje při svém debutu, když Chelsea otočila zápas s Wimbledonem a postoupila do třetího kola Ligového poháru (2:1